By

By

A new series on The Exponential Actuary of the Future

Forward to Part 6

Back to Part 4

The future of actuaries cannot be ascertained without looking at the macro "meta-trends" working in the larger scheme of things... In the fifth post of a new series on The Exponential Actuary of the Future, which outlines multiple scenarios for the future of the actuarial profession, we are undertaking a deep-dave into the actuarial and societal meta-trends.

Analysis of meta-trends

So far we have been assuming that automation meta-trends will come by themselves; reality is far more uncertain with regards to these as well. Here, we analyze these and various meta-trends in depth. This can give us the power to understand a rapidly changing world and adapt accordingly. While there are many meta-trends that vary by subject and by writers, here we showcase meta-trends drawn up by EY and PwC to act as a sample for us to understand them better.

EY identifies three primary forces as globalization, demographics and technology. It is the different combinations and parameters that lead to 8 mega-trends of:

- Industry redefined; any industry can enter any other industry now with decimation of most barriers to entry and bolder visions

- The future of smart: how AI and technology is creating an intelligent future

- The future of work: impact of sharing economy on work, emergence of soon-to-arrive machine economy and how will we adapt to these?

- Behavioral revolution: critical thinking from behavioral psychology/economics, sociology and philosophy is being brought out from the ivory towers into practical reality to nudge our behavior towards better and more sustainable outcomes in cost-efficient manners

- Empowered customers: customers demand from insurance the same experience as from big tech. There is hyper-personalization and fluid identities which rely more on peer approval/disapproval instead of paid advertisements. How will the businesses today give customers what they want?

- Urban world; AI is being applied to handle the enormous challenges facing urban cities, to make them smart cities. More and more challenges for humanity will be handled in the cities and their role in the future is both paramount and necessary.

- Health reimagined: technology is coming to conquer our extremely escalating health challenges

- Resourceful planet: can we overcome scarcity and reach abundance instead of greed and inequality?

These 8 mega trends arising from the 3 primary forces can be visualized as per this illustration of EY:

Insurance Nexus also describes three "mega-trends" for the insurance sector in its Global Trend Map:

1. Worldwide low interest rates coupled with soft market conditions

2. The complexification of risk in today’s increasingly globalized and connected societies

3. Distribution disruption and insurance’s customer-centric turn

See also: Three Megatrends by Insurance Nexus (or read it as a PDF)

While mega-trends might seem all-encompassing and very powerful, reality is far more random and extreme than we credit it with, as per Nassim Nicholas Taleb. Fat tails and extreme events shape human reality and thoughts, and we have to mature our qualitative profiling to take account of these. For instance, regional wars, nationalistic politics, the sudden spread of bio-weapons leading to the creation of fear-based societies focused on absolute obedience, as well as many other extreme events, can sometimes evaporate a mega-trend.

On Automation and its impact on actuaries

According to PwC, 37% people fear that automation will replace their jobs; actuaries are no exception to this. This is because AI can now automate routine work that is logical, structured and repetitive like most of office work is. Automating work that is dynamic in a heterogeneous environment and where the human touch is involved, like self-driving cars, plumbing, nursing and educating children, is far more difficult to automate in the near-to-medium term.

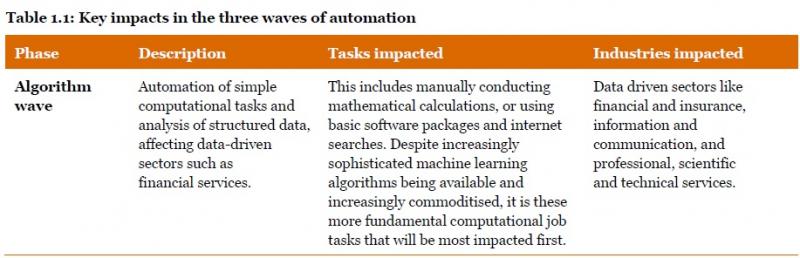

PwC analyzed 200,000 jobs in 29 countries to assess the potential of automation within the next twenty years. This study identified three waves of automation:

- Wave 1 (to early 2020s): algorithmic

- Wave 2 (to late 2020s): augmentation

- Wave 3 (to mid-2030s): autonomy

The key summarized description of the these three waves is given by PwC here:

There are broadly three sides to this automation argument:

- The first side argues automation is not something to be scared of and it has always been like that. We have always changed jobs due to technology from discovering fire to modern industry and machinery. Most of people were farming but changed to industries and then to the service industry. Fears from technology were aroused from Aristotle to Keynes but new jobs were invented and created to replace those displaced. This automation wave is beneficial and will allow us to leave the worst of jobs like bomb disposal, sewage treatment etc. and work that is routine and mundane will be automated away from the offices so that humans can focus on higher-order skills like being humans, creative problem solving, polymath broad focus over many subjects and so on. We underestimate capitalism. It was predicted to have ended long ago; it didn’t and it morphed into more totalitarian and pervasive forms. Capitalism will create more meaningless, pointless jobs. As David Graeber argues in “Why Capitalism creates pointless jobs”: “It’s not entirely clear how humanity would suffer, were all private equity CEOs, lobbyists, PR researchers, actuaries, telemarketers, bailiffs or legal consultants to similarly vanish. (Many suspect it might markedly improve.) Yet apart from a handful of well-touted exceptions (doctors), the rule holds surprisingly well.” Stability was the usher of previous epochs but relentless change is the mantra in our capitalist epoch. Relentless change in the means of production and technology is unavoidable.

- The second side argues that this time it WILL be different because, for the first time, we will have machines that can think on their own. All previous technologies had no minds of their own and worked in specific ways that they were designed for only. And then the discourse shifts from automation to AI apocalypse where AI can destroy humanity. Again, this point of view seems outlandish but all of these thinkers - from Elon Musk to Stephan Hawking to Bill Gates - are not talking about the narrow, weak AI that we have right now and that only does specific tasks; they are talking about strong general AI that can learn on its own, teach on its own, become a global hive mind and be self-aware of itself. And then there is tech singularity; quantum computing, machine teaching, global mind, AI blockchain marketplaces combining to form general AI. In this scenario, any job that a human can do, AI can do better. What is the solution then? Their proposal is to merge humans with machines in Brain Computer Interfaces. They argue that the only way to survive is merging of technology with society and biology. Sociobiology is the future due to nano technology, genetic engineering, neural lace etc. our biology is the ultimate barrier and evolution is too slow; we will take the next step by merging technology with biology. In that case, if we have BCIs to make us have 10,000 IQ that arguing about future of actuarial profession becomes totally obsolete and pointless as we will be completely different human beings then.

- Problem is distributional not technological; good utopia of creative play and no-work abundance society can be created through proper social policies that do not institutionalise financial inequality and greed. From Stephan Hawking to Jeff Bezos to Bill Gates, many notable people have explicitly voiced their concerns that technology like AI will tear down the fabric of society unless we start improving our social policies like introducing Universal Basic Income, taxing robots and so on. Sweden has such a welfare system that creates optimum conditions for innovation, pushing ahead in technology and caring about people instead of jobs.

This broad question of what does the future hold for us as humanity and civilization is discussed in the piece “Future outlook of our collective samsara”, which argues that we will have an ‘escalation’ scenario in the future and not utopia or dystopia.

We can argue about the impact of automation on actuaries for the first scenario. The second scenario is unpredictable as we will become something else entirely. Within the first scenario, the onus for future-proofing rests upon the actuarial profession and not upon governments and welfare systems. In the third scenario, actuaries can focus relentlessly on achieving their potential and learning, instead of being worried by financial responsibilities and the fear of being made jobless and redundant. With the right social buffers, actuaries will likely become happier to take risks, will stop being hand-cuffed by legacy systems, will likely leave their jobs for learning and training and start opening up their own Insurtech startups in the algorithmic economy.

The following may be the impact on actuaries in the first scenario:

- More pressure to learn programming, data science, big data and AI

- Improving soft skills and communication will be crucial

- Those at entry level or those that stopped learning long ago will start getting displaced. Polarisation will enter as top actuaries are hired to supervise the software systems and there is no longer need for entry-level actuaries (as all of their work has been automated)

- Focus on continuous learning; no longer one fixed path towards qualification, as qualifying alone won’t mean much. Burnout and early retirement might peak within the top actuaries.

Future of work and education

It’s not just automation, the world of work is set to be disrupted at an unprecedented pace, which will change how we work, when we work, the type of work we do, what does it mean to be an employee and what can we expect from employers. Sharing economy, flexible working, knowledge economy, global connectivity, focus on creativity, machine economy, different work expectations on the part of the millennial generation, this all interacts dynamically to change what it means to work and to have a living and career.

Susskind argues that professions have earned a privileged position in society, ‘a mandate for control in their fields of specialization’. In essence the professions are a type of social contract: they are the gatekeepers to specialised knowledge and expertise, they are allowed to self-regulate their activities, and we place our trust in them to advise and help us. Knowledge is power. And it is centralised.

Susskind argues that this social contract has many drawbacks – in particular, the professions are notoriously conservative and reluctant to change – but until recently there was no better system. Now, though, technology allows us to consider alternatives like tapping into crowd wisdom like peer-to-peer insurance does. Is a professional society like SOA better suited to the future or universities or MOOCs? How will we impart self-learning in the future?

The major work done by an actuary and a data scientist isn’t technological, but sociological: their job is to communicate with the heads of companies and with the broader public about how data can be used to improve businesses. Essentially, data scientists are advocates for better data analysis and for more data-driven decision-making, both of which require constant vigilance to maintain. While the mathematical component of the work done by a data scientist is essential, it is nevertheless irrelevant in the absence of human efforts to sway decision-makers. Awareness of behavioral psychology and communication skills can radically improve actuaries’ sway over real decisions and their implementations.